Sales

HRD Training Prog No 10001377173 Date & Time 3 – 4 September 2025, 9.00 a.m. – 5.00 p.m. Registration Deadline 27 August 2025 Learning Format In-Person Training

Overview

Civil Engineering Completed Risk (C.E.C.R) insurance is a specialized annual cover for operational risks. Items that can be insured include expressways, highways, bridges, tunnels, railway tracks, ports, wharfs, and breakwater structures and pipelines. It is arranged and renewed on a yearly basis. This programme will present best practices in coverage and how claims are handled. Policy wording and clauses will be reviewed and discussed.

Case studies will also be used to educate participants on how this policy is used to insure completed highways and related infrastructure works. The trainer is an experienced engineer from the insurance industry based in Singapore and he will share his enormous experience with the participants.

Recommended For

- Staff with at least three years of related experience and deals with engineering property insurance.

- Executives, Underwriters and Managers from insurance/reinsurance companies and broking firms.

- Also suitable for Loss Adjusters; Claims, Business Development and Marketing Executives from insurance/reinsurance companies;

- Client and Account Executives and Managers of insurance/ reinsurance broking firms;

- Insurance buyers – Highway Concession Companies, Owners of Pipelines and Airport Operators, Government Departments and Local Authorities.

Learning Outcome

- Appreciate the coverage afforded by the C.E.C.R policy.

- Highlight the importance of arranging such policy for completed engineering risks.

- Learn the specific peril(s) that are considered.

- Formulate best practice when undertaking C.E.C.R risk and related issues.

- Understand the claims handling aspects for this class of insurance and its application.

Programme Structure

| Day |

Content |

|

1 |

|

|

2 |

|

Dates

03/09/2025

Two-Day Classroom

Fees

Early Bird

Registration before 13 August 2025

Aii Member (Single):

RM 1,650/USD 380

Non-Member (Single):

RM 1,750/USD 402

Normal Fee: Single

Aii Member:

Single: RM 1,750/USD 402

Non-Member:

RM 1,850/USD 425

Normal Fee: Group of 3 pax

Aii Member:

RM 1,600/USD 368

Non-Member:

RM 1,700/USD 390

Meet The Expert

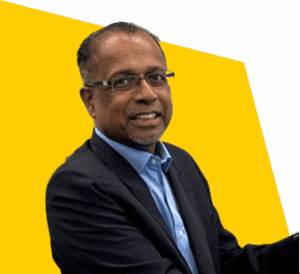

| IR. POOBA MAHALINGAM Regional Risk Consultant – Singapore |

|